Introduction

The sale of an appreciated commercial property, home or business generally requires the payment of capital gains tax on the profit. Depending on the size and nature of the transaction, there could potentially be significant tax implications. Before a real estate or business sales transaction is finalized, it’s important to consider the implications of the tax liability on the final realized gain.

One strategy for the seller to defer and potentially lower their capital gains tax rate

is to break up the cash flows from the sale over several years using a structured installment sale. An installment sale is generally defined as a sale of property at a profit for which the seller will receive one or more payments from the purchase price after the close of the taxable year in which the sale occurs. Downsizing homeowners and retiring business owners are examples of sellers who can benefit from an installment sale.

This whitepaper discusses the impetus for an installment sale, including the U.S. Internal Revenue Service (IRS) guidelines that makes this option legally permissible, and outlines how-to steps for structuring the installment sale.

Tax consequences of a real estate transaction

In general, the tax rate on the capital gains from a real estate transaction can range between 0% and 20% of the profit made when selling the property. There is a further tax called the Net Investment Income Tax (NIIT), which may apply as well, and adds 3.8% in tax if your income exceeds certain levels. Capital gains on the sale of real estate are calculated by subtracting the amount paid for the property (including the cost of capital improvements) from the sale price and subtracting any transaction costs. Additionally, a seller may be able to exclude the first $250,000 of gain from the sale of a primary residence ($500,000 for a married couple filing jointly) for income for tax purposes, if certain conditions are met.

IRS Publication 523, “Selling Your Home,” includes a six-step eligibility test to determine whether a seller is eligible for the maximum exclusion on the gain. For example, the seller must have owned the home and used it as their main residence for at least two of the five years before the date of sale in order to exclude the capital gains from the sale. There are some exceptions to the ownership and use rules (e.g., those in the military or who are disabled). The seller also cannot have used the exclusion for any residence sold within the last two years of the current sale. Additionally, a home sale isn’t eligible for the exclusion if the seller acquired the property through a like-kind/1031 exchange during the past 5 years, or if the seller is subject to expatriate tax.

Tax consequences for the sale of a business

A business usually has many assets. When sold, these assets must be valued, and that valuation must be recorded and accounted for. In addition, the assets must be classified as capital assets, depreciable property used in the business, property held for sale to customers such as inventory or stock in trade, etc. The gain or loss on each asset is then figured separately. For example, the sale of capital assets results in capital gain or loss and the sale of inventory results in ordinary income or loss.

Using installment sales in the sale of real estate or businesses

The sale of real estate or a business can be executed as a cash sale or as an installment sale. With a cash sale, the buyer purchases the property or business and pays the seller the full agreed-upon sales price on the day of the closing. The buyer could pay for the transaction with cash that they already have on hand, or they could pay through financing on their own from a bank or third-party lender. The latter allows the seller to get paid in full while the monthly payments are made to the financing institution by the buyer.

In an installment sale, instead of the seller receiving one lump sum from the proceeds from the sale, all parties agree to installment payments for a stated number of years as a condition of the sale. Taxpayers contemplating a sale of property or a business at a gain may wish to consider using the installment method, because it may provide favorable tax treatment in that the taxes are paid as the installment payments are received, rather than being paid entirely in the year of disposition. In this way, sellers may be able to take advantage of lower capital gain tax rates. Additionally, because of the potential tax benefits to the seller, a buyer may be able to make a more attractive purchase offer than if the transaction wasn’t purchased in installments. It is important to note that the installment sale must be agreed upon before the sale of the property or business takes place; it cannot be established if the funds have already been exchanged between the seller and the buyer.

Sections 453 and 453B of the Internal Revenue Code outline tax rules applicable to installment sales. In general, a seller is only permitted to use installment sales for capital assets held for over a year. Accounts receivable and/or business inventory, however, do not qualify for installment payments because taxes must be paid on those business assets in the same year in which they are sold by the business, even if payments are received in later years. Additionally, a seller cannot use the installment method to report gains from the sale of inventory or stocks and securities traded on an established securities market. The seller must report any portion of the capital gain from the sale of depreciable assets as ordinary income under the depreciation recapture rules in the year of the sale. Also, installment method rules do not apply to sales that result in a loss.

At least one payment in an installment sale must be made after the tax year in which the sale occurs. U.S. Treasury Regulation Section 15a.453-1(b)(3)(i) defines “payment” to include amounts actually or constructively received in the taxable year under an installment obligation. The seller is required to report capital gains on an installment sale under the installment method unless they “elect out” on or before the due date for filing their tax return (including extensions) for the year of the sale. Under Section 453(d)(1) and Treas. Reg. Section 15a.453-1(d)(1) of the Internal Revenue Code, a taxpayer may elect out of the installment method by paying tax on the entire gain in the year of the sale.

In 2012, three related private letter rulings (PLRs) were issued by the Internal Revenue Service regarding installment sale tax rules. At question was whether the modification of an installment sales obligation by deferring the maturity date, substituting a new obligor, and altering the interest rate is a disposition or satisfaction of the installment obligation within the meaning of Section 453B. Under the facts presented, the rulings in summary provide that, “modification of an installment obligation by deferring the maturity date, substituting a new obligor, and altering the interest rate is not a disposition or satisfaction of an installment obligation for purposes of the installment sales provisions under Section 453B. Moreover, where the original installment note is replaced, the substitution of a new promissory note without any other changes is not a disposition of the original installment note under Section 453B.”1

Benefits of periodic payments with structured installment sales

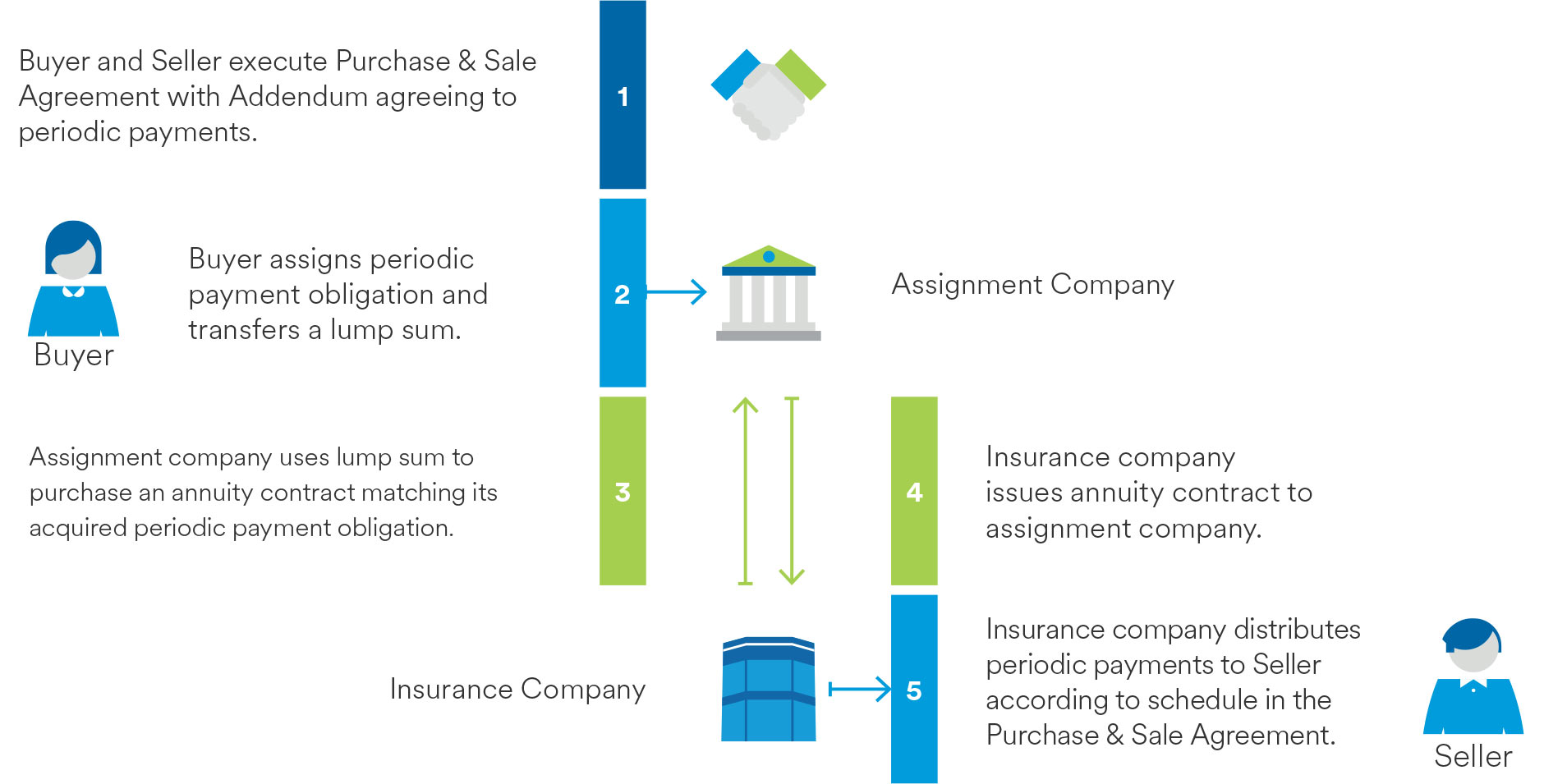

Those who opt for an installment sale may want to consider a structured installment sale, which utilizes a periodic payment plan that enables the spread of capital gain taxes coupled with dependable installment payments over time.2 Structured installment sales add an insurance company to the installment sale. The insurance companies providing such payments are highly regulated and have strict reserve requirements designed to prevent insolvency. They also typically have strong financial strength ratings from leading credit ratings agencies, which demonstrates their ability to meet future financial obligations.3

With a structured installment sale, the buyer does not make periodic payments to the seller. Rather, they assign the payments to the insurer’s assignment company which agrees to take on the obligation and make the guaranteed payments. This way, the buyer has involved a highly rated insurance company and its financial strength to guarantee the future obligations, and the seller need not worry about its ability to make future payments.

With the structured installment sale, the seller isn’t required to receive all funds through periodic payments. The seller may decide to receive only a portion of the sale through guaranteed future payments and the remaining amount in a lump sum – or by any other agreed upon arrangement with the buyer.

A case example:

To understand how a structured installment sale works, we have included below a hypothetical case example of a sale of a real estate business by Bill in 2024.

After 25 years of operating as the sole owner of a successful real estate agency, Bill decided he would sell a portion of the business to prepare for his future retirement. His company is a C Corporation and, after consulting with his legal and tax advisors, they recommended the partial sale be structured as a stock sale. Bill listed the sale price at $1,130,000 for a 40% ownership stake in his business.

With interest from two serious bidders on the table, Bill again consulted with his tax and legal advisors who helped him determine that a structured installment sale would best suit him. A buyer was selected from among the two bids. Because this tax-advantaged option would require cooperation from the buyer, Bill reduced the sales price by $27,500 to $1,102,500. Bill and his advisors felt the resulting lower capital gains taxes and NIIT was worth a discount in price. The structured installment sale would supply Bill with periodic payments to supplement his retirement income and would defer capital gain taxes on the sale beyond the year of the transaction. On account of the lower sales price, the selling expenses were reduced from $64,000 to $60,000. The adjusted basis of the stake was $200,000. As part of the Purchase and Sale agreement, the purchase price of $1,102,500 would be payable as follows: $291,117 in cash this year, with $150,000 payable annually for 6 years beginning next year.

If Bill had received the sale proceeds in a lump sum ($1,130,000), he would have to pay over $124,000 in federal capital gains taxes assuming a marginal capital gains tax rate of 20% plus about $23,400 in NIIT. But, by utilizing a structured installment sale, he will pay about $14,700 of federal capital gains taxes this year on the $291,117 payment and $0 federal income taxes in each of the following 6 years on the $150,000 annual payment primarily on account of the 0% capital gains tax rate. Further, the structured installment sale significantly reduces the NIIT to $0. A portion of each installment sale payment will be deemed interest, which Bill will report on his annual income tax returns. In the end, using a structured installment sale reduced Bill’s associated capital gains taxes and eliminated the NIIT. Further, it helped give him peace of mind through a dependable income stream.

How were Bill’s federal income taxes calculated on the structured installment sale?4 Income taxes were computed by first determining the amount of gross profit (none of which is subject to depreciation recapture rules): Selling price of $1,102,500 less adjusted basis (including expenses of the sale) of $260,000 equals a gross profit of $842,500. The gross profit factor is 76% ($842,500 gross profit divided by $1,102,500 contract price). Bill will receive $291,117 in the year of the sale. In applying the gross profit factor of 76% to this payment, Bill must report $221,249 of associated long-term capital gain. This results in about $14,700 of federal capital gains taxes and $0 of NIIT. Bill will receive the remaining $811,383 in 6 annual payments of $150,000 beginning next year. In applying the gross profit factor of 76% to $135,231 of each of the 6 payments ($811,383/6), $102,776 from each of these payments will be taxable as long-term capital gain; this example assumes $14,769 ($150,000-$135,231) of each payment is taxable as interest with the remainder of each payment being a nontaxable return of basis. Annually, this results in $0 of federal income/capital gains taxes and $0 of NIIT.

How-to steps for structured installment sales

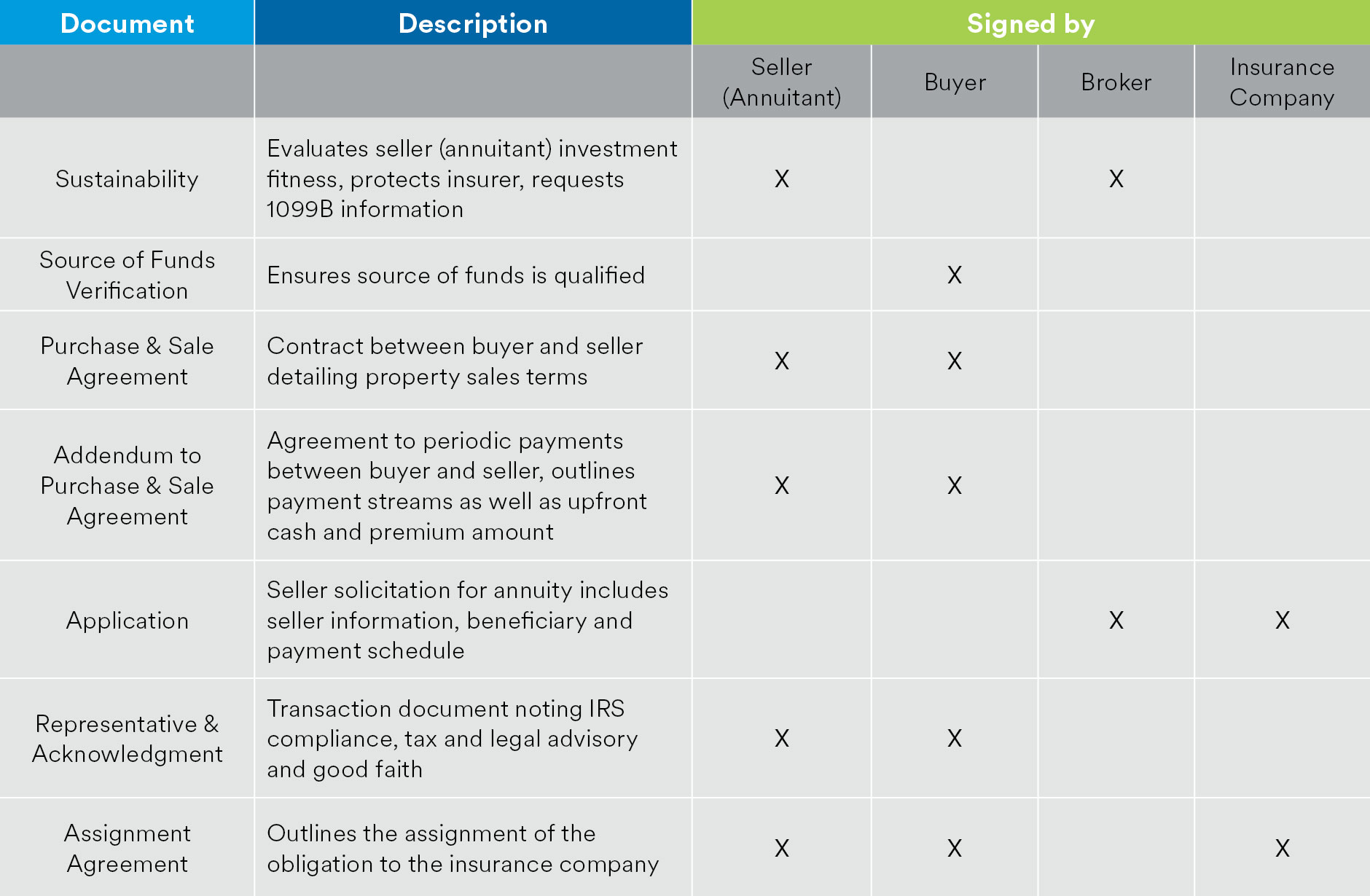

When working with your clients (i.e., the seller and/or buyer) on a structured installment sale, there are several documents that will need to be completed prior to the sale. These include a Suitability form; a Source of Funds Verification, which presents source of qualified funds for the transaction; a Purchase & Sale Agreement between the buyer and seller; an Addendum to Purchase & Sale Agreement, which outlines the periodic payment agreement between the buyer and the seller; an Application for the annuity; the Representation & Acknowledgment, a good faith document that represents to the assignment company the necessary facts for it to take on the obligation; and, an Assignment Agreement, which assigns the buyer’s obligation to the insurance company making the installment payments.

What documents are required?

Below is an example of how the structured installment sales work from a practical perspective:5

Conclusion

A structured installment sale can be an attractive way for your clients to defer and potentially reduce their tax liability when selling a home or business. By spreading the payments through multiple years via a structured installment sale, capital gains taxes as well as net investment income taxes would be deferred and potentially reduced, while providing the seller with dependable income from the sale.

About the Authors

Matin Momen, Vice President & Associate General Counsel, Product Tax & ERISA, MetLife; Maureen Darrow, Assistant General Counsel, Product Tax & ERISA, MetLife; and, Bejan Shirvani, Assistant Vice President, Structured Settlements, MetLife.