Post Retirement Benefits

Risk transfer solutions to reduce liabilities

Keep Your Promises

Traditionally, post retirement benefit offerings, including retiree life and retiree medical benefits, have played a critical role in attracting and retaining employees. Today, many companies still have open retiree life and retiree medical plans. With rising healthcare costs and increased market volatility, plan sponsors continue to evaluate strategies to help ensure they can meet the promises made related to these benefits. Given the long-term nature of these liabilities, plan sponsors are exposed to investment risk, interest rate risk and longevity risk, all of which create challenges around managing these liabilities.

Retiree Medical

A risk transfer solution such as a retiree medical buyout can help plan sponsors mitigate risks associated with the plan. A retiree medical buyout, issued by a highly rated insurance company, transfers the obligation to pay retiree healthcare benefits from the corporate sponsor to the insurer. For plan sponsors, aside from mitigating risks, solutions like a retiree buyout help to mitigate balance sheet volatility and can have tax advantages. For retirees, it improves security of these promises by shifting these obligations to an insurer with deep expertise and a long history of managing these risks.

Retiree Life

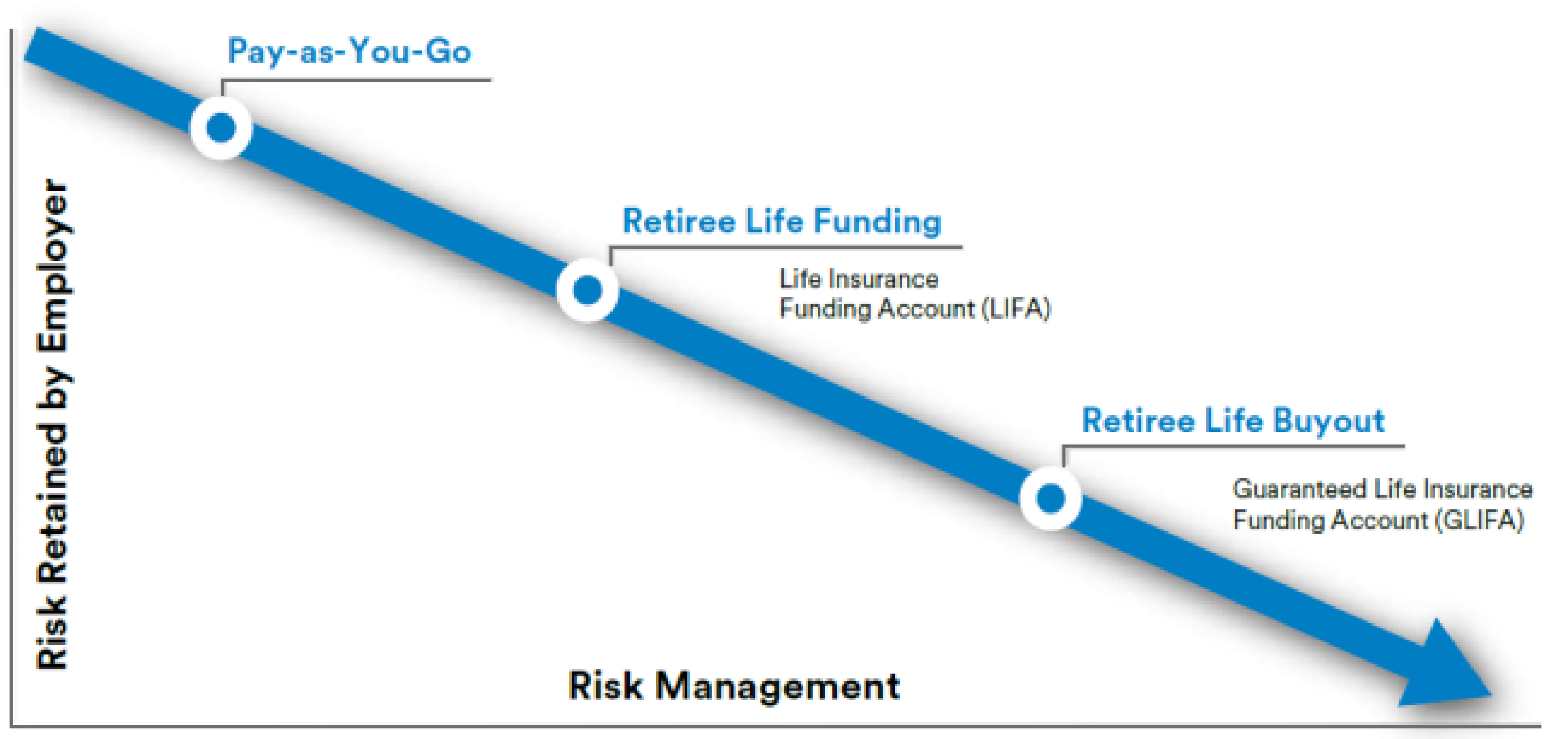

We understand the unique financial challenges that come with providing retiree life benefits on a pay-as-you-go basis. Our retiree life funding solutions lower your long term "out-of-pocket" premium, mitigate risk and improve financial security for your employees.

Our Retiree Life Insurance Solutions Enable Your Company to:

- Reduce long-term costs through tax efficiency

- Strengthen financial statements

- Improve benefit security for retirees

Explore Our Solutions

Retiree Life Funding

Comfortably set aside money to cover retiree life insurance costs with a retiree life funding program.

Retiree Life Buyout

Transfer your company's retiree liability and plan administration to MetLife with a retiree life buyout.

MetLife Funding Agreement

Fund general employee benefits or transfer plan assets into a MetLife Funding Agreement.

Retiree Medical Buyout

Transfer your company's retiree medical liability and plan administration.

Our Life Insurance Funding Account (LIFA) allows your company to:

- Pre-fund future retiree life premiums in a tax-advantaged reserve

- Reduce long-term expenses for retiree life insurance premiums

- Improve financials by offsetting ASC-715 (or GASB 74/75) accounting liabilities

Our Guaranteed Life Insurance Funding Account (GLIFA) allows your company to:

- Transfer ASC-715 (or GASB 74/75) accounting liability on existing retirees to MetLife

- Cap future costs associated with retiree premiums

- Eliminate retiree life recordkeeping and associated administrative burdens and costs

A MetLife Funding Agreement:

- Can be used to pay for future insurance premiums, to fund liabilities, or as an investment allocation for welfare benefit funding

- Provides safety, convenience and flexibility

- Ensures a principal and interest rate guarantee1

Retiree Medical Buyout:

- Help plans to eliminate or reduce ongoing operational and financial liability

- Secure the medical benefit promise to retirees by transferring to an insurer

Risk Solutions

As a top insurer in the risk solutions market, MetLife’s long history and experience in managing risk sets us apart. Discover how MetLife Risk Solutions supports our customers by reducing risk and uncertainty, and helping them deliver on their long-term promises.

Why Choose MetLife?

Expertise At Your Side

Our dedicated Post-Retirement Benefits (PRB) team brings a wealth of experience to your funding solution.

Simplicity You Can Count On

Our retiree life solutions were designed with the flexibility to simply and efficiently fund and/or transfer a plan sponsor’s retiree life insurance liabilities.

Solutions Tailored To Your Needs

We take a consultative approach, working with you to tailor our solutions to meet your organizational objectives.

Meet the Team

Get to know the people who will help you make the best choices for your company’s retiree life benefits.

1All guarantees are subject to the financial strength and claims paying ability of the issuing MetLife company.

Retiree Medical

For current ratings information and a more complete analysis of the financial strength of MetLife, please go to www.MetLife.com and click on “About Us” and then click on “Company Ratings.”

The Retiree Medical solution includes a group annuity contract issued by Metropolitan Tower Life Insurance Company, a wholly owned subsidiary of MetLife, Inc. (“MetLife”). Like most group annuity contracts, MetLife group annuities contain certain limitations, exclusions and terms for keeping them in force. Ask a MetLife representative for costs and complete details.

Neither MetLife nor its representatives provide tax, accounting, legal or investment advice. The rules relating to such matters are subject to interpretation and change. The appropriateness of any product for any specific company may vary depending on the facts and circumstances. Employers should consult with and rely upon their own tax, accounting, legal or investment advisors.

Metropolitan Tower Life Insurance Company, 5601 South 59th St., Lincoln, NE 68516.

Retiree Life

Neither MetLife nor its representatives provide tax, accounting, legal or investment advice. The rules relating to such matters are subject to interpretation and change. The appropriateness of any product for any specific company may vary depending on the facts and circumstances. Employers should consult with and rely upon their own tax, accounting, legal or investment advisors.

To enjoy the tax advantages associated with the Guaranteed Life Insurance Funding Account (GLIFA) and Life Insurance Funding Account (LIFA) products, prefunding must be within tax code limits that generally limit prefunding for post retirement group term life insurance to a $50,000 maximum coverage amount over the working lives of covered employees, and actuarially determined on a level basis, using assumptions that are reasonable in the aggregate.