1 Subject to applicable legal, contractual and regulatory restrictions.

2 Fortune 500® data reflects 2020 business which includes Metlife Auto & Home®, now acquired by The Farmers Insurance Group®.

3 Some Regional Service Centers are operated by MetLife affiliates and some by third parties contracted by MetLife

4 Chile Pension Fund Administrator Assets Under Management (Superintendencia de Pensiones, FY2017). Mexico: Life and Major Medical combined direct premium

(EstadisticAMIS and FinanciAMIS 2017). Chile & Uruguay: Life, A&H, Annuity and Medical combined direct premium (AXCO FY2017).

5 Based on life insurance premiums: AXCO Global Statistics 2017: Argentina, Bolivia, Chile, Dominican Republic, Guatemala, Honduras, Panama, Peru, Puerto Rico, Uruguay and Venezuela. SUSEP 2017: Brazil. Fasecolda 2017: Colombia. EstadisticAMIS and FinanciAMIS 2017: Mexico. Bolsa de Valores de Guayaquil 2017: Ecuador

6 Life markets rankings based on life insurance Gross Written Premiums (GWP). Sources: Regulator and trade association reports; MetLife internal analysis for asterisked*countries in the following list. Top 10 positions in 19 markets are: Bahrain*, Bulgaria, Cyprus, Czech Republic, Egypt, Greece, Hungary, Jordan, Kuwait*, Lebanon, Oman*, Poland, Qatar*, Romania, Russia, Slovakia, Turkey, Ukraine and the U.A.E.*

7 Based on current book of business, as of July 2018

8 Based on Annual Premium Equivalent, Insurance Association of China, FY2017

9 Based on GWP, Japan statutory filings, FY2017

10 Based on GWP, Korea Financial Supervisory Service, FY2017

Note: MetLife affiliates and subsidiaries in non-U.S. jurisdictions are not authorized to sell insurance in the U.S.

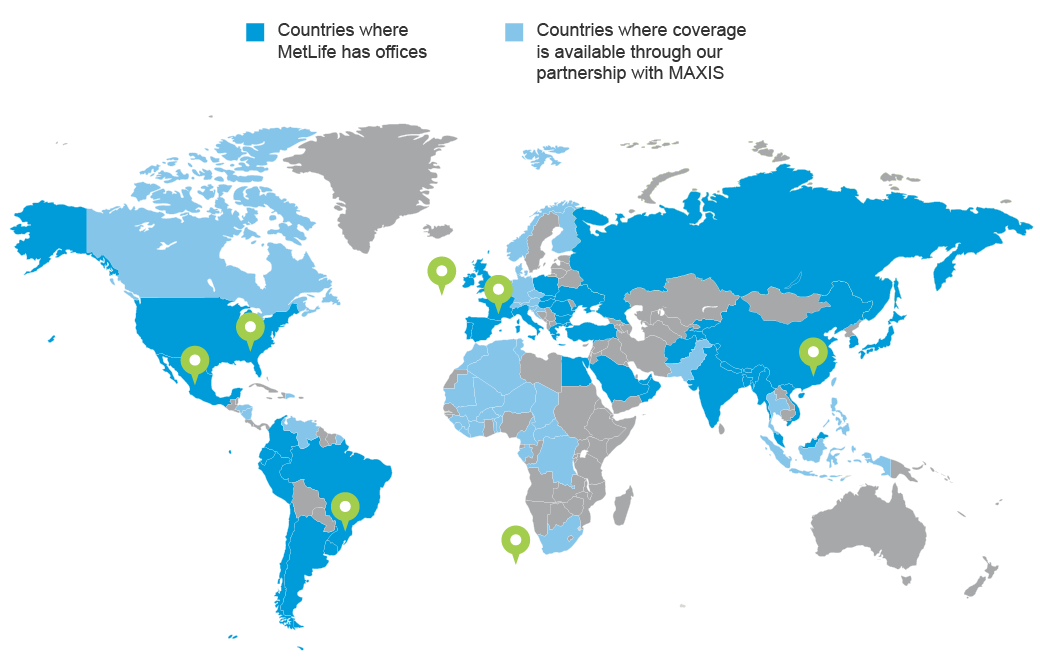

Multinational Pooling and Captive Management services are provided through MAXIS Global Benefits Network (“MAXIS GBN”). MAXIS GBN, a joint venture between Metropolitan Life Insurance Company (“MLIC”) and AXA France Vie S.A., administers a network of independent, locally licensed member insurance companies (“MAXIS Members”). MAXIS GBN is neither an insurance provider nor an insurance intermediary and only the MAXIS Members provide insurance. MLIC is the only MAXIS Member licensed to transact insurance business in New York. The other MAXIS Members are not licensed or authorized to do business in New York, and the policies and contracts they issue have not been approved by the New York Superintendent of Financial Services and are not subject to the laws of New York.

Like most group benefits programs, benefit programs offered by MetLife contain certain exclusions, exceptions, waiting periods, reductions, limitations and terms for keeping them in force.