MetLife Retirement & Income Solutions

Whitepaper: Structuring an Employment Settlement: A Tax Efficient Solution

Introduction

When an employee recovers damages for a wrongful termination, discrimination, harassment and other claim, they may have the option to choose whether to receive the money in a lump sum, or with periodic payments known as a structured settlement. This whitepaper discusses the impetus for settling an employment litigation case, as well as how a structured settlement works as an alternative to a lump sum settlement payout, including the U.S. Internal Revenue Service (IRS) guidelines and case law that makes this option legally permissible. Finally, it outlines how-to steps for structuring the settlement.

It is a well-known fact that only a small percentage of employment litigation casesgo to trial. In fiscal year 2022, 73,485 charges of workplace discrimination werefiled with the U.S. Equal Employment Opportunity Commission (EEOC), which represents an increase of almost 20% when compared to the previous fiscal year. While it’s too early to assess the outcome of those cases, an analysis of employment cases from January 2009 through July 2017 by legal research service Lex Machina found that of 54,810 cases that were filed and closed, employees bringing the suits won just 1% of the cases in trial. Employers wonabout 14%. Another 7% were settled on procedural grounds, mostly dismissing the employee’s claims. The vast majority (78%) were dismissed by either the employee or both the employee and employer, but Lex Machina assumes that most of those 42,742 cases ended in a settlement.

Some advantages of settling for the employee are avoiding a lengthy trial, legal costs, the emotional toll of a trial, and the chance to move on with their lives. For a company defending itself from an employment claim, agreeing to settle a case can help mitigate legal risks and avoid the costs and reputational risk of a protracted trial. Additionally, in a settlement agreement, a plaintiff typically waives the right to bring further claims under various statutes such as the Age Discrimination in Employment Act (ADEA), the Americans with Disabilities Act (ADA), and Title VII of the Civil Rights Act (Title VII) in exchange for lump sum payments.

Settling an employment case may also help an employer avoid class actions, which can drain corporate resources long before the case even reaches a trial or settlement. Class action settlement awards can be significant. For example, the top 10 settlements in various employment-related class-action categories totaled $1.32 billion in 2018, and this is only a small fraction of the employment litigation that was filed.1

Using Structured Settlements for Employment Cases

What is a structured settlement? Since the Revenue Act of 1918, amounts received for personal physical injury or workers' compensation have been exempt from taxation. In 1954, Internal Revenue Code (IRC) Section 104 was created to allow exclusion from income damage awards from personal physical injury cases. The Thalidomide tragedy of the 1960s brought attention to the fact that payments paid over time from the manufacturers could more fairly compensate the injured children in those cases and, per IRC Section 104, personal physical injury payments are excluded from income and income tax. In 1983, IRC Section 104 was formally amended to allow settlements for periodic payments and assignments of those payments. This was when structured settlements became what we know today as the periodic payment settlement solution. Prior to the 1983 legislation, settlements were mainly awarded as single lump sums because of the administrative burden on the defendant and the claimant, and defendant not wanting to economically tie themselves togetherfor an extended period due to the adversarial nature of the relationship. So, claimants were burdened with the task of managing the cash award themselves with varying success.

A non-qualified structured settlement is designed to accept the transfer of a periodic payment obligation for cases that fall outside of personal physical injury claims and litigation as defined under IRC Section 104(a)(1) & (2). Structured settlements for non-physical injury employment litigation (also called “non-qualified settlements”) are similar to personal physical injury structured settlements.2 The key difference is that non-qualified settlement proceeds are not tax-exempt once received but are tax-efficient. The money accrues tax-free in a settlement annuity until payment – at which time it becomes taxable.3 Non-qualified employment settlements include, but are not limited to, cases for emotional distress, discrimination, harassment, wrongful termination, etc.

Benefits of Structured Settlements for Employment Lawsuits

Outside of wages, almost all employment-related awards, together with attorneys’ fees, can be paid out over time via structured settlements. A structured settlement provides a guaranteed, stable and secure income stream to the employee in the form of an annuity,4 regardless of the inevitable ups and downs of the financial markets. A payment schedule can be designed to suit the employee’s financial needs and helps to avoid financial mismanagement. This includes extending the corresponding tax obligation over future years, meaning that if the claims are structured properly, claimants and/or their attorneys will pay taxes in the year payments are received.

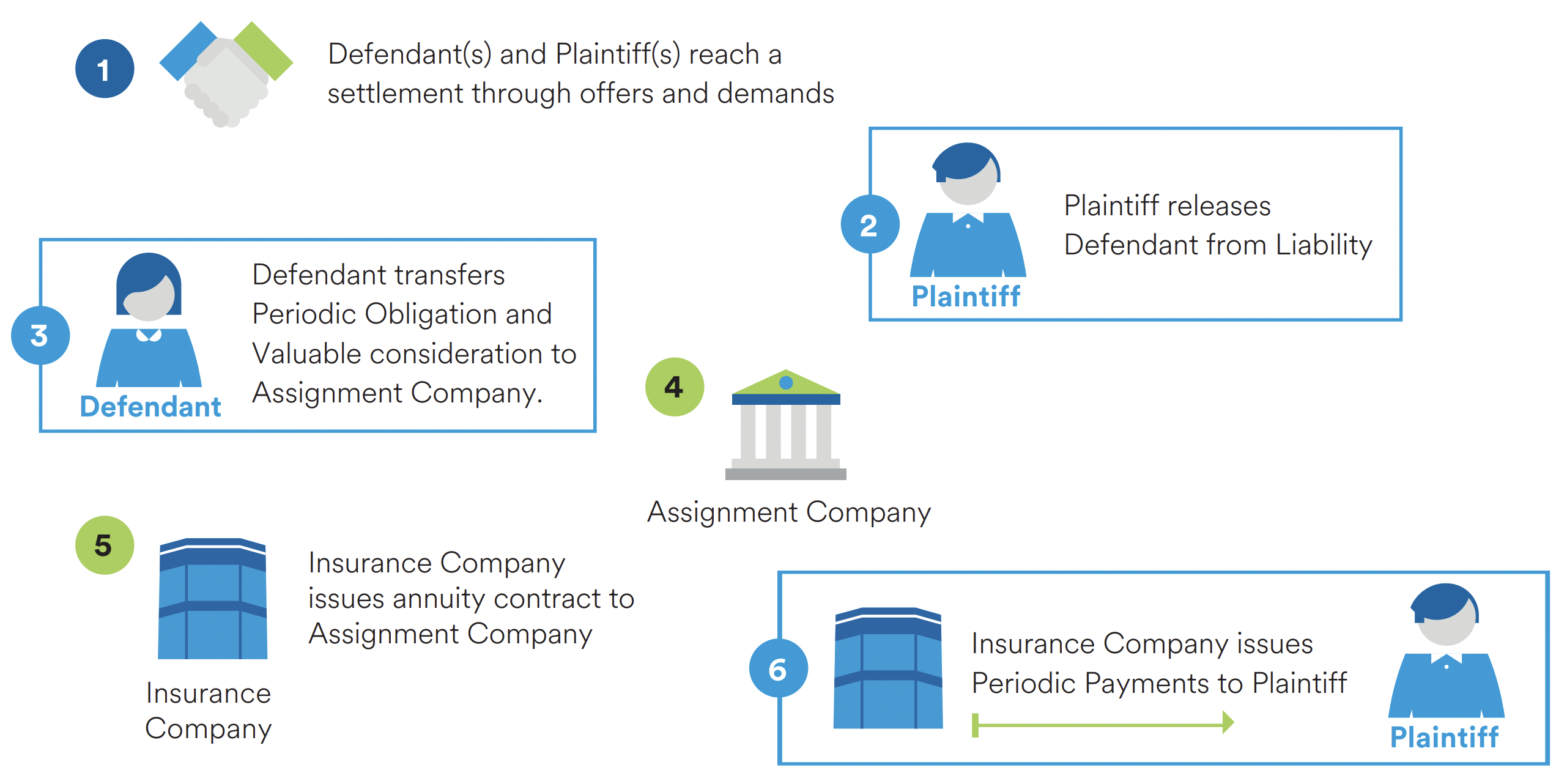

Assignment Transaction

A benefit of using a structured settlement for the company/defendant is the ability to transfer to the insurer the administrative responsibilities associated with issuing periodic payments, along with the mortality and investment risk of the periodic payments. There is typically no risk of payment default, as structured settlements are guaranteed by the highest-rated insurance companies.

Treatment of Employment-Related Settlement Payments: A Four-Step Process

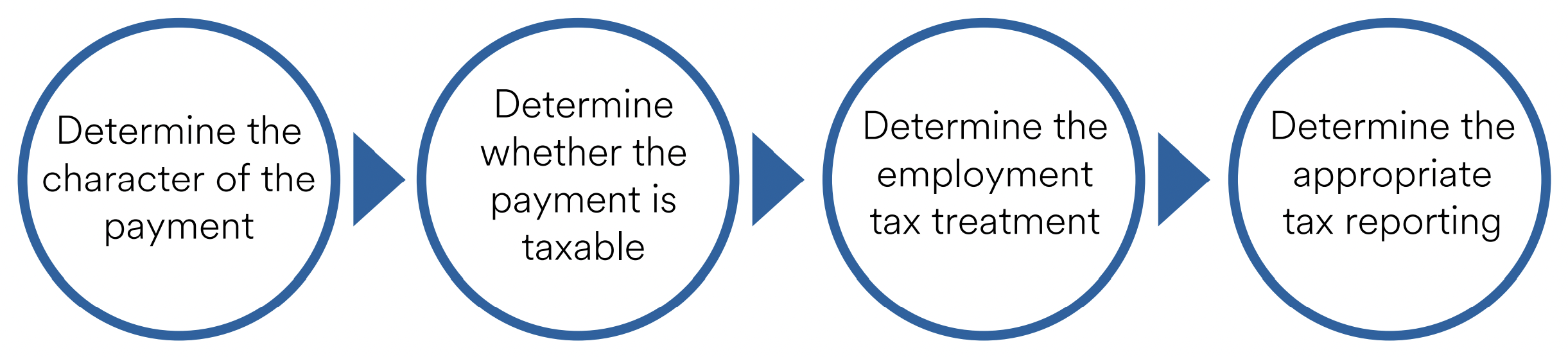

In 2008, an Internal Revenue Service Private Letter Ruling (PLR 200836019) provided insight about how the IRS will interpret the tax laws regarding the use of non-qualified structured settlements to resolve employment claims. The ruling stated that periodic payments can be made to claimants rather than a lump sum of cash, and doing so enables claimants to receive both guaranteed payments and tax deferral.5 In an internal memorandum dated October 22, 2008, the Internal Revenue Service (IRS) Office of Chief Counsel outlined a four-step process used to determine how to treat employment-related settlement payments.6

The IRS Counsel Memorandum helps taxpayers understand how the IRS may determine the tax treatment of employment-related settlement payments. It outlines both the income and employment tax consequences, as well as the appropriate reporting, of settlement payments in four steps outlined below:

Step One: Determine the Character of the Payment

The first step of determining the character of the payment being made for income tax purposes is important in deciding whether a payment is ultimately taxable and whether a payment constitutes "wages" for employment tax purposes (steps two and three in the four-step process). The IRS outlined the most common types of judgment and settlement payments made in connection with employment-related disputes. This includes severance pay, back pay, front pay, compensatory damages, consequential damages, punitive damages and restoration of benefits. In addition, the IRS Counsel Memorandum also lists and describes some of the statutes under which employees (or former employees) might bring lawsuits, such as Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act (ADEA) of 1967, the Americans with Disabilities Act of 1990 (ADA), state statutes and common law wrongful termination.

Step Two: Determine Whether the Payment is Taxable

The IRS notes that damages recovered from an employment-related dispute are generally not recoveries for a personal physical injury where 104(a)(2) provides a taxability exception. Therefore, the most difficult questions are usually whether the amounts are wages for employment tax purposes (Federal Insurance Contributions Act (FICA) and income tax withholding), the proper reporting of the amount for Form 1099 or Form W-2, and reporting of attorneys’ fees on Form 1099. Regarding attorneys' fees, the IRS Counsel Memorandum cites Commissioner v. Banks (543 U.S. 426 (2005)), in which the Supreme Court ruled that a claimant generally must include the entire amount of a taxable judgment or settlement in gross income, including any portion paid to an attorney as a contingent fee. Attorneys will generally need to have a fee arrangement in place at the time of settlement which provides for the structuring of payments solely from the claimant’s settlement proceeds.

Structuring of attorney fees could have important legal and tax consequences, particularly when you consider that The Jobs Act, signed by President George W. Bush on October 22, 2004, allows an above-the-line deduction for amounts attributable to attorneys' fees and costs received by individuals based on claims brought under the False Claims Act, section 1862(b)(3)(A) of the Social Security Act 34 or unlawful discrimination claims, which are covered under numerous statutes. Attorneys should consult with their own tax and legal advisors prior to agreeing to structure legal fees to determine the tax and other legal consequences.

Step Three: Determine Employment Tax Treatment

The IRS Counsel Memorandum discusses general rules for income tax withholding in connection with common types of settlement payments for employment-related disputes, and discusses the appropriate reporting for each payment, noting that a judgment or settlement payment may comprise multiple elements, each of which may or may not be wages. This could include back pay, emotional distress damages and interest. The determination is made by considering all facts and circumstances, including the remedies available for the claim.

Step Four: Determine Appropriate Reporting

Finally, the IRS Counsel Memorandum lays out the reporting requirements for employment-related settlement payments, including wage reporting, special reporting requirements for back pay, Form 1099 reporting and payments to attorneys.

Using a non-qualified structured settlement assignment

Required Documentation

Several documents need to be completed by employment counsel and/or tax advisors in cooperation with the structured settlement broker to receive the correct tax treatment for a periodic payment settlement via a non-qualified structured settlement assignment.

- The Settlement Agreement specifies the parties to the agreement (i.e., the plaintiff, defendant, etc.), the payment schedule, including payments due at the time of settlement, as well as the periodic payments to be made to the plaintiff. If a settlement is being structured, annuity payments must begin within one year, be substantially equal, and be paid out in regularly scheduled intervals at least annually. The settlement agreement also specifies any attorney’s fees included in the settlement and identifies the governing law for the agreement and other contractual obligations for the parties for the settlement.

- Non-Qualified Assignment and Release document (which includes the settling parties plus the assignment company and life insurer) will match the settlement agreement, but it also includes important rights and duties for the parties with regards to the annuity.

- Additional documents required by an insurer include:

- an application for the non-qualified structured settlement annuity - where payee and beneficiaries are established;

- a W9 and a W4P form for tax reporting;

- a proof of birth document - if payments are paid out for the remainder of the life of the payee; and,

- depending on the complexity of the case, additional documents could include court orders, trusts and guardianship documentation.

How Payment Amounts are Determined

There are several factors that come into play in calculating the payout of the structured settlement including the employee’s age and gender (if applicable), which will factor into their expected life expectancy. While payments can cover a claimant’s entire lifespan, they could also choose to be paid out over just 5 years, 10 years or any other term. Any remaining payments, should they pre-decease the end of the term, would go to their named beneficiaries and generally avoid the probate process.7

The claimant will also need to consider how much to structure. While wages can never be structured, the amounts due for other damages including emotional distress will be included in their ordinary income in the year they receive it. If the payments are paid at the same time as the wages, it could push up a claimant’s one time award into the highest marginal tax brackets. A structured settlement provides a fairer way for the plaintiff to receive their funds over time, where there are no wages and the claimant could potentially continue to be taxed at their typical marginal income bracket.

A Case Example:

To understand the benefits of a structured settlement, let’s take a look at anexample of a hypothetical sexual harassment case that resulted in a wrongful termination. Through the settlement process, the claimant, Jane Doe, a resident of Florida, is due to receive $750,000 from the lawsuit.

Jane can either receive a lump sum or structure her settlement.

- A cash lump sum today would yield a tax bill of $197,165* and a take-home settlement of $552,835..

- Alternatively, Jane could structure $650,000 into a 20-year structured settlement while taking $100,000 today to replace her lost income and supplement other considerations. The $650,000 structured settlement annuity would provide a guaranteed $4,056 every month for 20 years thereafter. This annuity wouldprovide an annual income of $48,672, on which $2,098 in taxes* are due eachyear. Over the year payout period, choosing this option would provide Jane with$973,459.20 plus the initial $100,000. Overall, she would be guaranteed$1,073,459.20 before taxes.

By structuring her settlement, Jane would pay an estimated $50,199 tax bill over time vs. a $197,165 tax bill, which would need to be paid immediately from the lump sum. This is at least a nominal tax bill savings of $146,966, highlighting the tax efficiency of the structured settlement.

*Tax computations assume: Jane’s filing status is married filing joint; the applicable standard deduction is $27,700; settlement income is taxreported on IRS Form 1099-MISC and thus is not W-2 income; no additional income; 2023 federal individual income tax rates apply for thelife of the arrangement; and state income taxes do not apply. This example is hypothetical in nature and actual results will vary.

Because needs are unique, a structured settlement can be tailored to address specific circumstances. The structured settlement can provide the security of preserving settlement proceeds while providing the claimant with the money they need, when they need it. Plus, the structured settlement spreads the income tax liability across future years.

Conclusion

Employment counsel and tax advisers should take particular care in structuring an employment settlement and drafting the settlement agreement, particularly when determining the correct tax treatment of employment-related settlement payments. In doing so, this arrangement can benefit both the employee and the employer in an employment-related case. By partnering with a reputable and experienced insurer, a non-qualified structured settlement annuity can help the employee receive predictable payments over many years while ensuring that their tax obligation – and their attorney’s – do not need to be paid in full at the time the settlement is reached. By entering into a non-qualified assignment from an insurer to fund the future periodic payments, the employer is relieved of the obligation to make the payments, it eliminates the need to set aside any future reserves for the claim, and it provides closure to all parties.

About the Authors:

Matin Momen, VP & Associate General Counsel, Tax & ERISA, MetLife, Bejan Shirvani, Vice President, Structured Settlements, MetLife and Harry Coleman, FLMI, AVP, Structured Settlements, MetLife

Download MetLife's 'Structuring an Employment Settlement' Whitepaper

Download1. Bloomberg Tax, “Top Class Action Settlement Values Rise in 2019, Law Firm Says,” January 13, 2020

2. Non-qualified structured settlements do not qualify for income tax exclusion under Section 104(a)(2) of the Internal Revenue Code.

3. Any discussion of taxes is for general informational purposes only and does not purport to be complete or cover every situation. MetLife, its agents and representatives may not give legal, tax or accounting advice and this document should not be construed as such. You should confer with your qualified legal, tax and accounting advisors as appropriate.

4. All guarantees are subject to the financial strength and claims-paying ability of Metropolitan Tower Life Insurance Company.

5. While an IRS private letter ruling (PLR) may only be relied upon by the taxpayer who received it, the broader tax community looks to PLRs for informal guidance and insight into how the IRS interprets and applies tax laws to specific sets of facts.

6. Memorandum, Office of Chief Counsel Internal Revenue Service, dated October 22, 2008, UILC: 61.00-00, 3101.00-00, 3111.00-00, 3402.00-00, Income and Employment Tax Consequences and Proper Reporting of Employment-Related Judgments and Settlements (the "IRS Counsel Memorandum").

7. Any discussion of estate planning is for general informational purposes only and does not purport to be complete or cover every situation. MetLife, its agents and representatives may not give legal, tax or accounting advice and this document should not be construed as such. You should confer with your qualified legal, tax and accounting advisors as appropriate

Attorneys will generally need to have a fee arrangement in place at the time of settlement which provides for the structuring of payments solely from the claimant’s settlement proceeds. Structuring of attorney fees could have important legal and tax consequences. Attorneys should consult with their own tax and legal advisors prior to agreeing to structure legal fees to determine the tax and other legal consequences. The method of tax reporting with respect to such fees is subject to change, where we deem such change to be required under the Federal tax law or IRS guidance.